Banking & Finance Law

Handling banking and finance law requires precision—whether it’s loan agreements, compliance, financial disputes, or regulatory filings. CasePal simplifies the process, helping you track contracts, manage financial clients, and streamline invoicing so you can focus on legal advisory, not administrative work.

✅ Everything in One Place – Store loan agreements, financial contracts, and compliance reports securely.

✅ Automated Task Management – Track regulatory filings, loan approvals, and contract deadlines.

✅ Client & Case Tracking – Manage banking clients and financial transactions in a structured system.

📌 A Banking & Finance Law Case – Walkthrough Example

🔹 Case: Your firm is advising a bank on a multi-million Rand corporate loan agreement

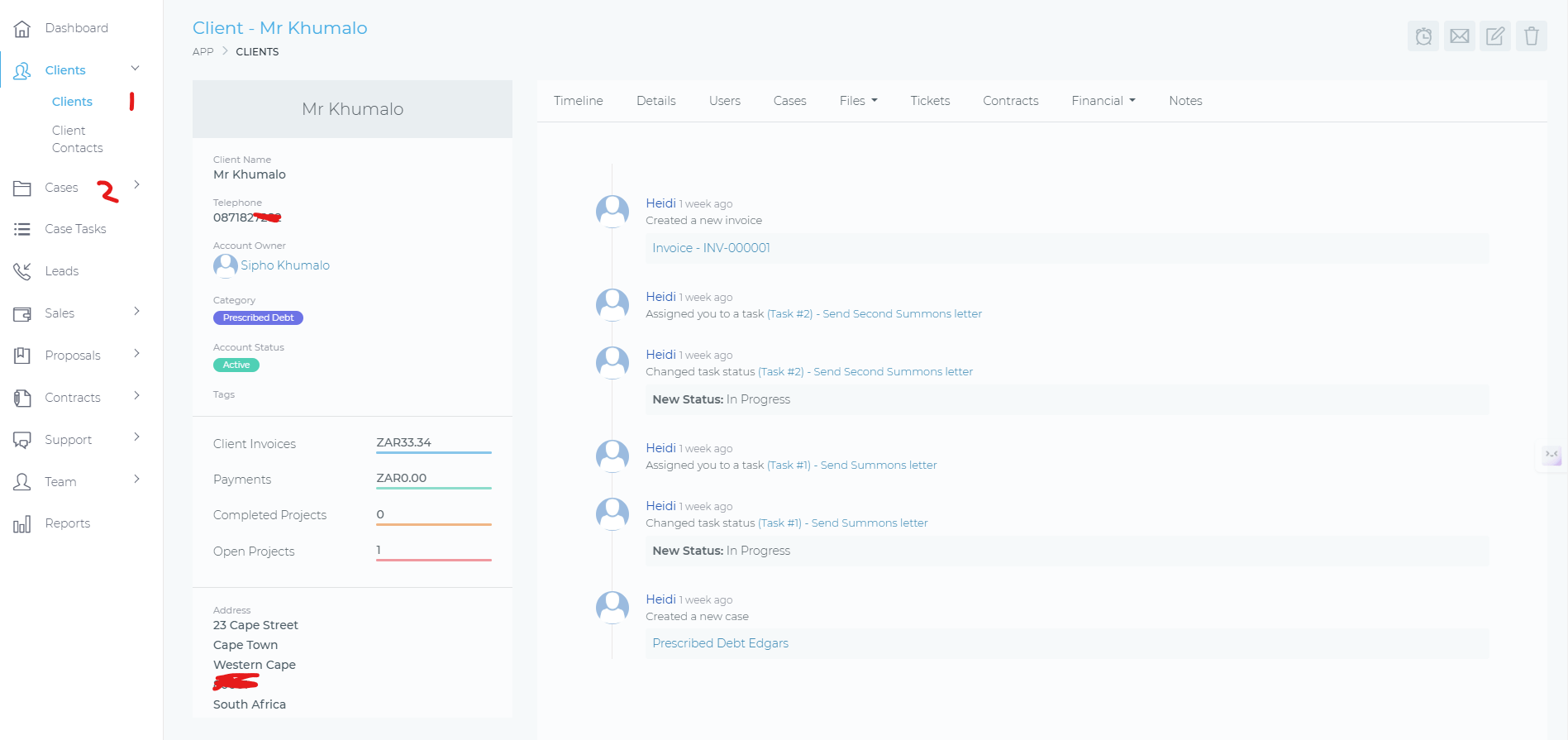

1️⃣ Step 1: Client Onboarding & Case Setup

✔ Enter the bank or financial institution’s details into CasePal’s client intake form (Company Name, Regulatory ID, Contact Person).

✔ The system automatically creates a case file where you can store contracts, compliance reports, and financial statements.

✔ Your client receives an email with a secure portal link to create their password and log in.

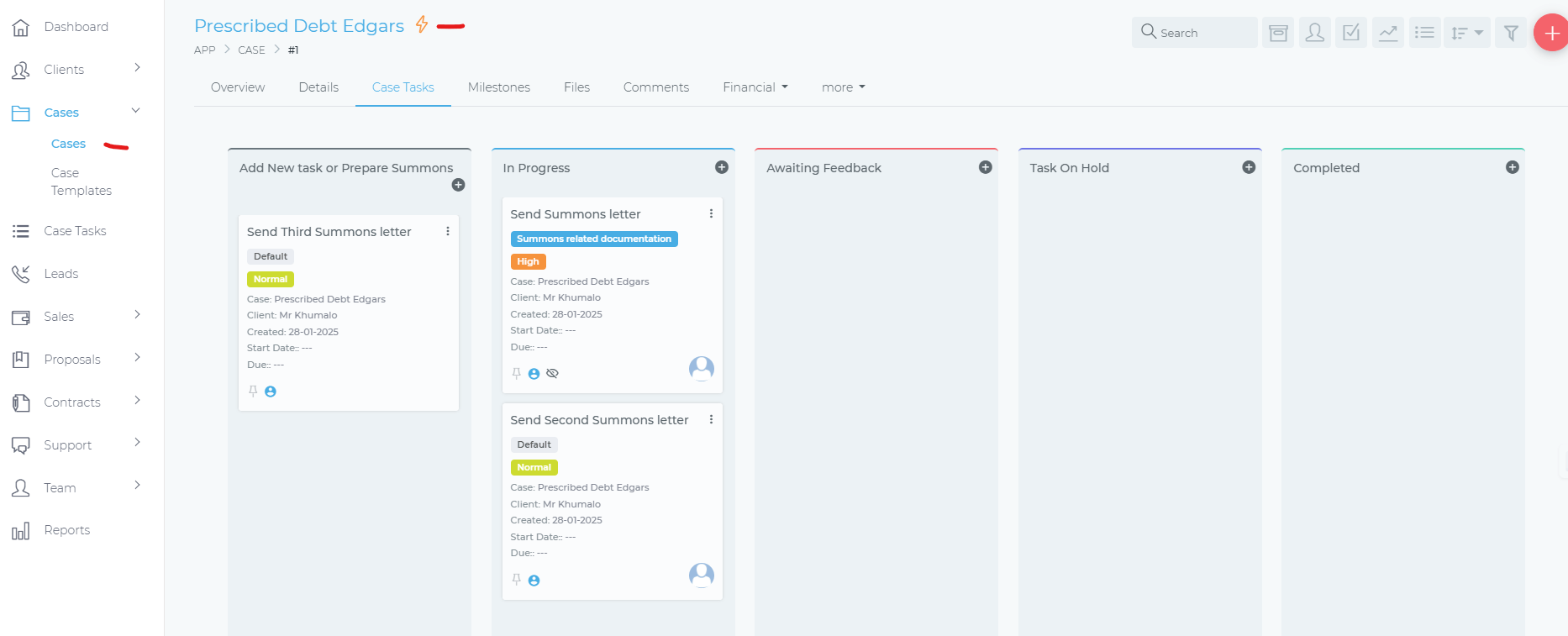

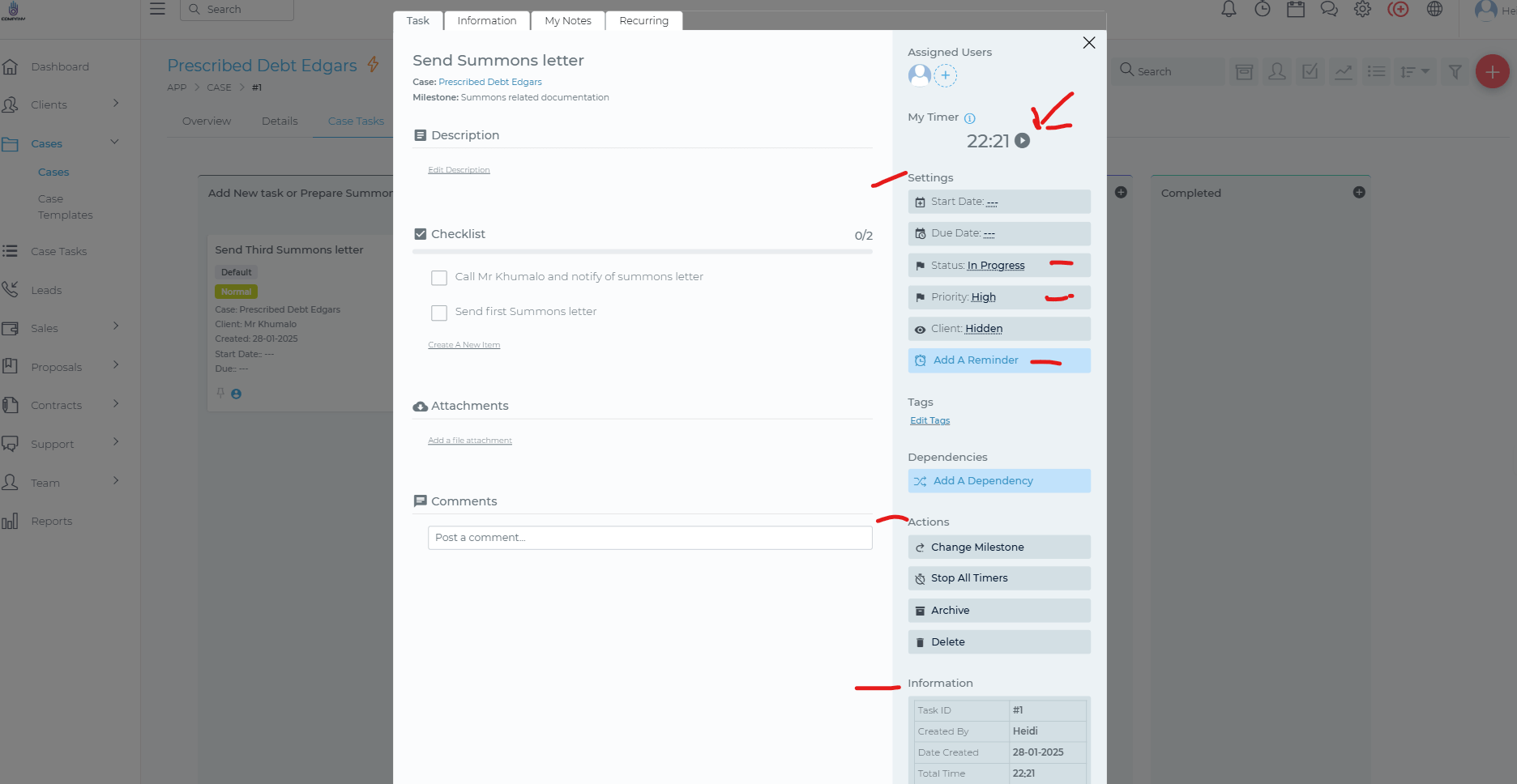

3️⃣ Step 3: Managing Compliance & Regulatory Deadlines

✔ Track banking regulations, financial transaction approvals, and compliance deadlines.

✔ Assign tasks to associates for due diligence reports and legal reviews.

✔ CasePal sends automatic reminders before key deadlines (e.g., loan agreement expiration).

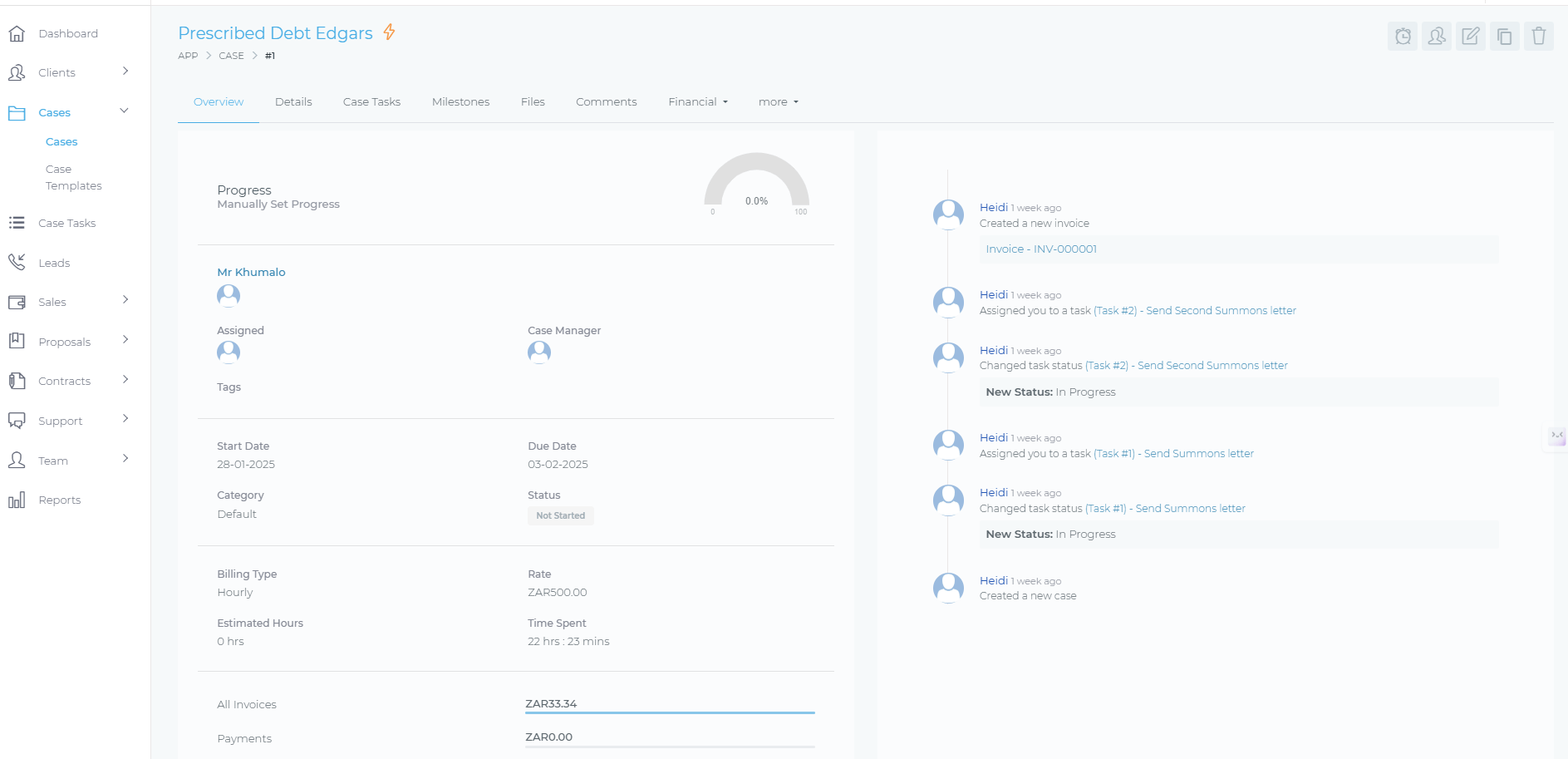

4️⃣ Step 4: Client Communication & Collaboration

✔ Clients log in to track financial case progress, submit compliance documents, and ask legal questions.

✔ All communication is logged in the client file—no more back-and-forth emails.

✔ Collaborate with financial regulators and auditors by granting temporary access to contract files.

✅ The Result? Banking legal matters stay structured, compliance is easily tracked, and financial clients always know the status of their cases.

🔹 What CasePal Does for Banking & Finance Lawyers

✔ Loan & Financial Agreement Tracking – Manage financial contracts, securities, and compliance deadlines.

✔ Client & Case Management – Maintain structured client profiles and track multiple financial cases.

✔ Regulatory Compliance Automation – Assign and track legal tasks related to banking laws, financial policies, and securities regulations.

✔ Document Storage & Sharing – Securely upload and manage loan agreements, financial contracts, and due diligence reports.

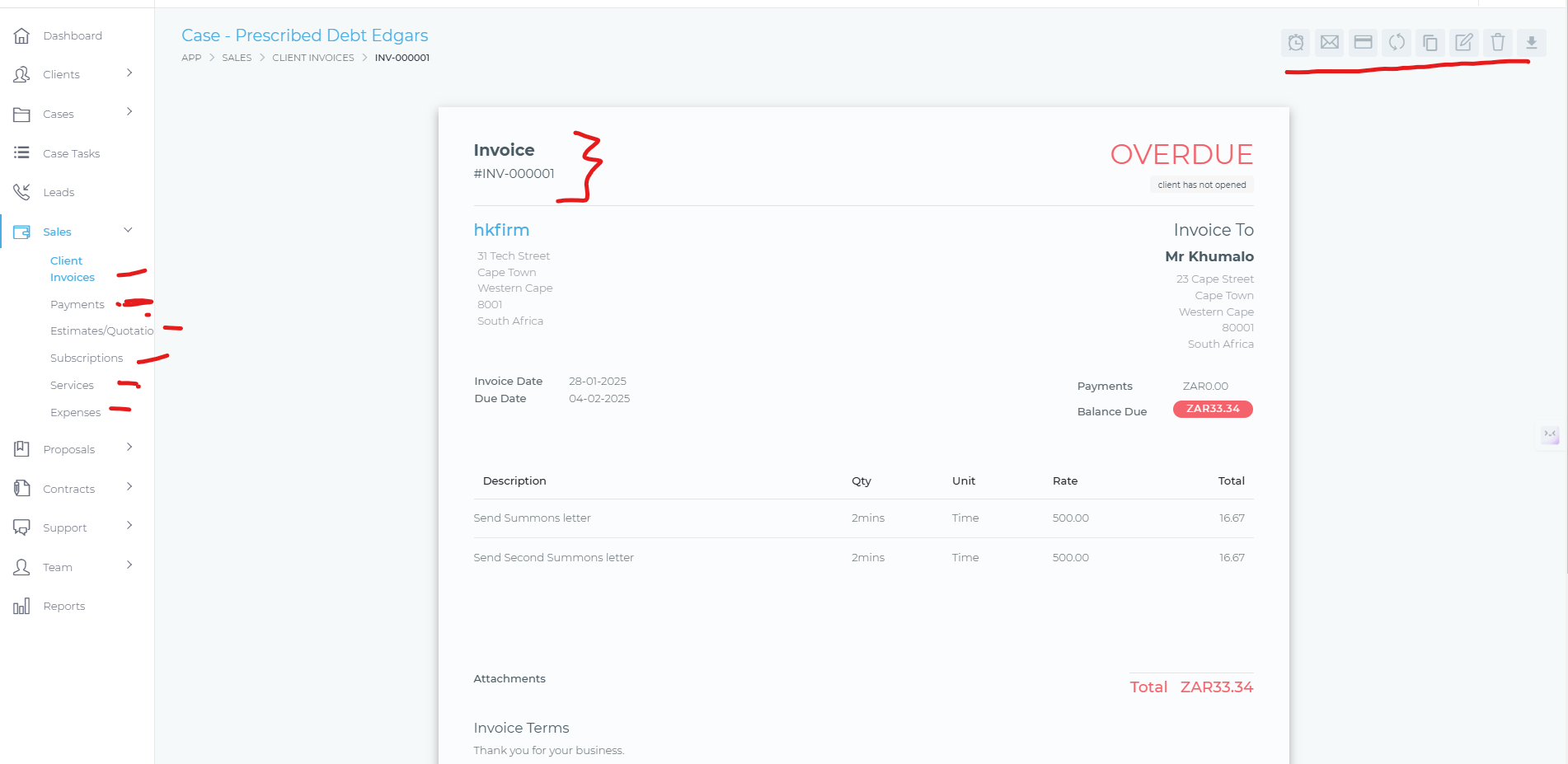

✔ Billing & Payments – Invoice per hour or flat fee, send estimates, and track payments seamlessly.

CasePal helps banking & finance lawyers focus on legal advisory, not admin work.

FAQs – Banking & Finance Lawyers & CasePal

1️⃣ Can I use CasePal to track financial compliance deadlines?

Yes! You can set up reminders for loan agreements, securities filings, and financial compliance requirements.

2️⃣ Can multiple lawyers or teams collaborate on banking cases?

Yes! You can assign different team members to specific contracts, compliance cases, or regulatory matters to ensure smooth collaboration.

3️⃣ Can my banking clients track case progress?

Yes! Clients can log into their secure portal to track regulatory filings, receive legal updates, and communicate with you.

4️⃣ Does CasePal support retainer billing for financial clients?

Yes! You can bill per hour, flat fee, or offer retainer-based billing for ongoing banking clients.

5️⃣ Is my financial data secure?

Absolutely! CasePal uses multiple encryption layers to protect all financial documents, client files, and regulatory reports.

CasePal Goes Beyond Banking & Finance Law Firms

🚀 Extra Services for Banking & Finance Law Firms

🔹 Law Firm Websites – Get a professional WordPress website optimized for financial law clients.

🔹 Cybersecurity & Compliance Training – Ensure data security for banking clients.

🔹 IT Support – Setup, troubleshooting, and legal software integrations.

🔹 Digital Marketing for Financial Law Firms – Google Ads, SEO, and LinkedIn marketing to attract financial institutions.

💡 Banking & finance law is complex—CasePal makes managing it simple.