Tax Law

ax law involves strict deadlines, complex compliance requirements, and ongoing regulatory changes. Whether you’re handling corporate tax advisory, SARS disputes, or VAT compliance, CasePal keeps everything organized—so you can focus on tax strategy, not paperwork.

✅ Everything in One Place – Store tax filings, compliance records, and client documents securely.

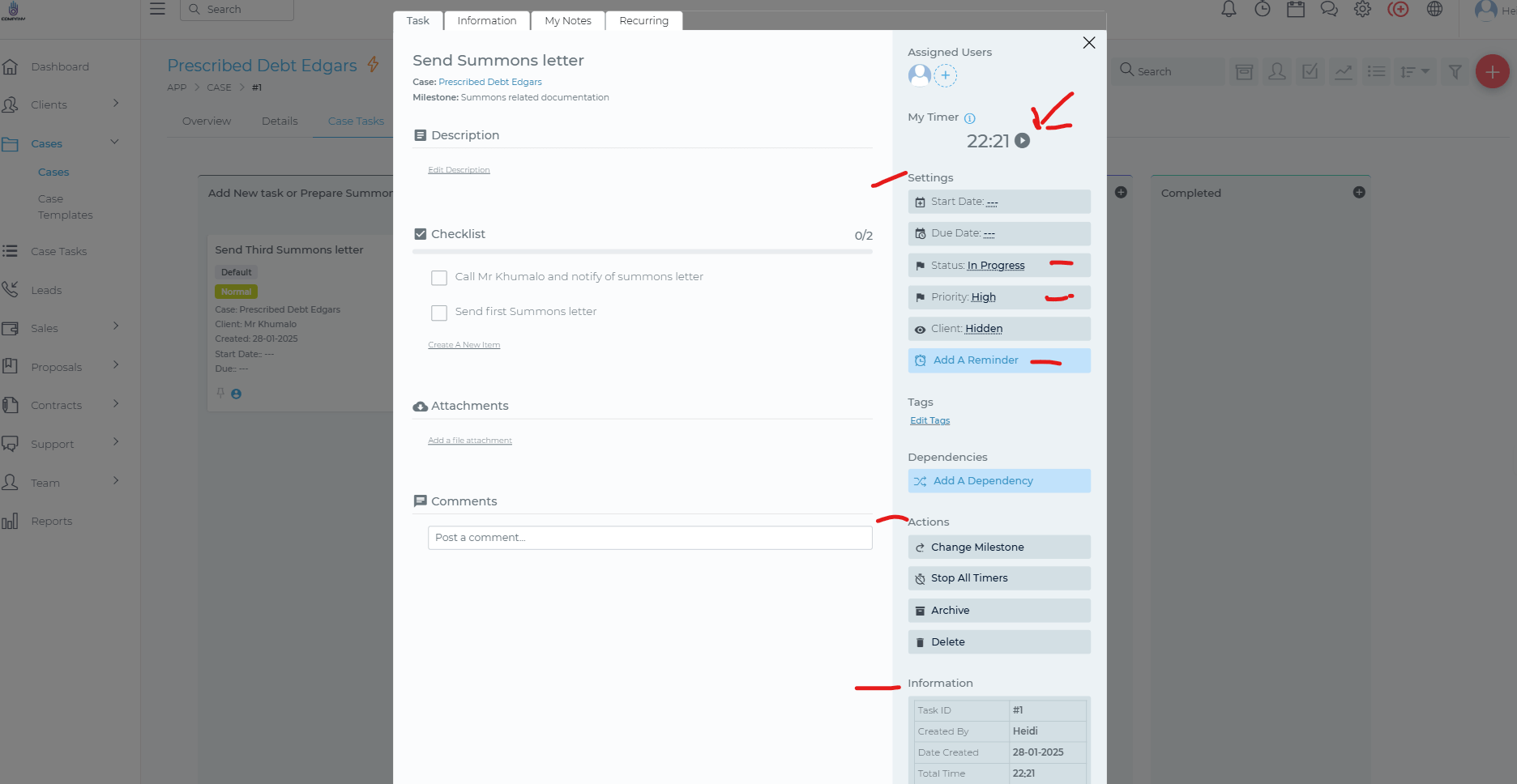

✅ Automated Deadlines & Reminders – Never miss a tax filing, appeal deadline, or compliance review.

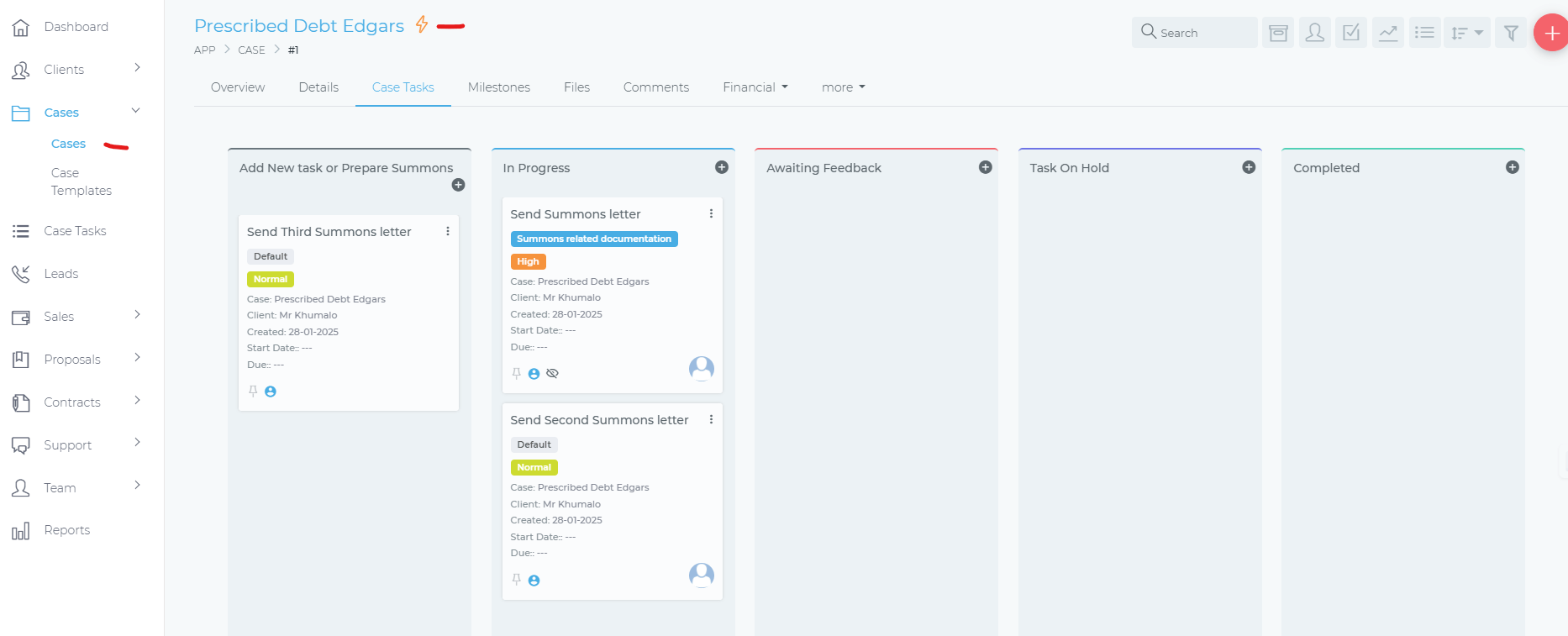

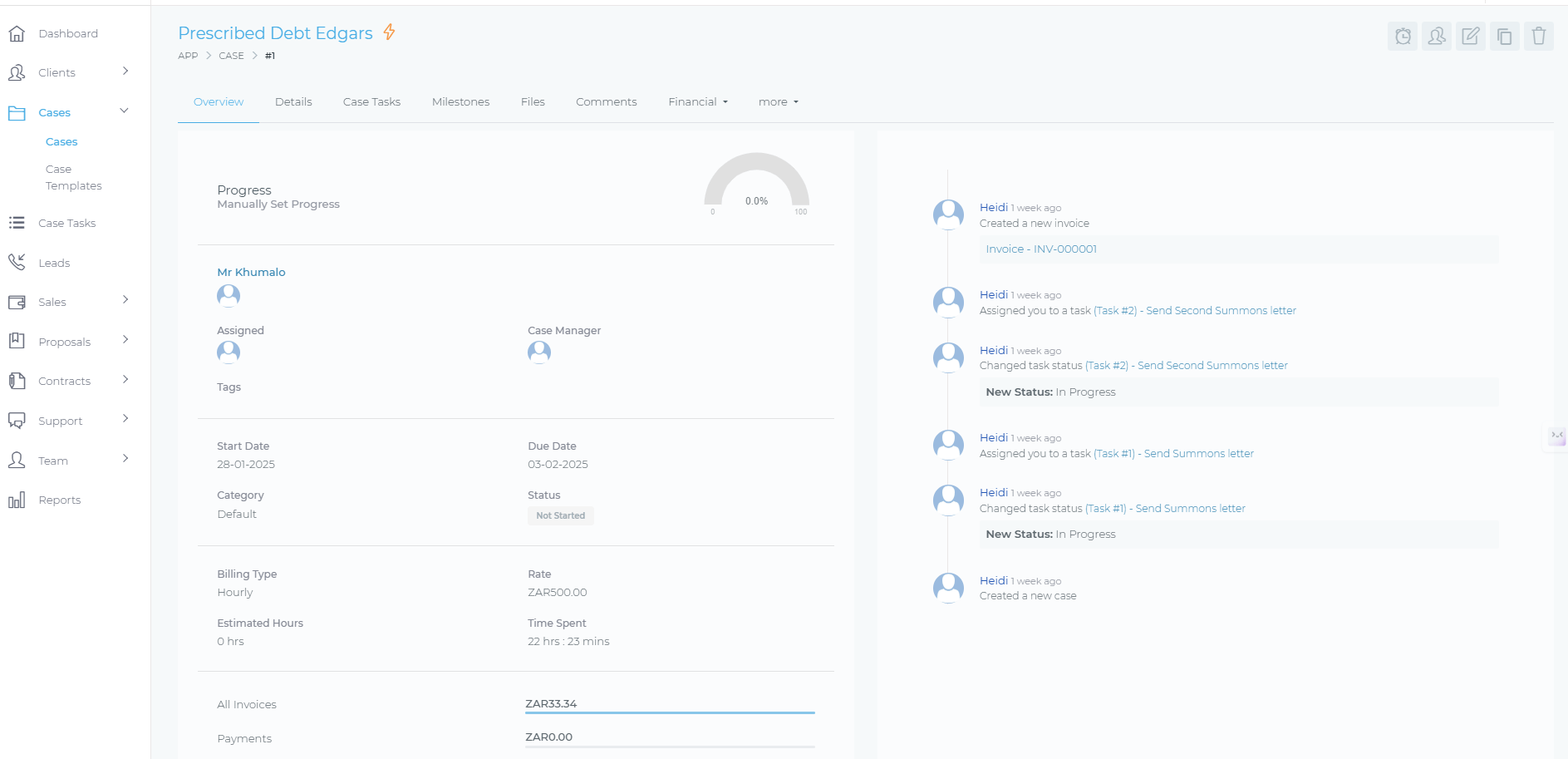

✅ Client & Case Tracking – Manage tax clients, audits, and disputes in a structured system.

📌 A Tax Law Case – Walkthrough Example

🔹 Case: Your firm is assisting a business with a SARS tax audit and appeal.

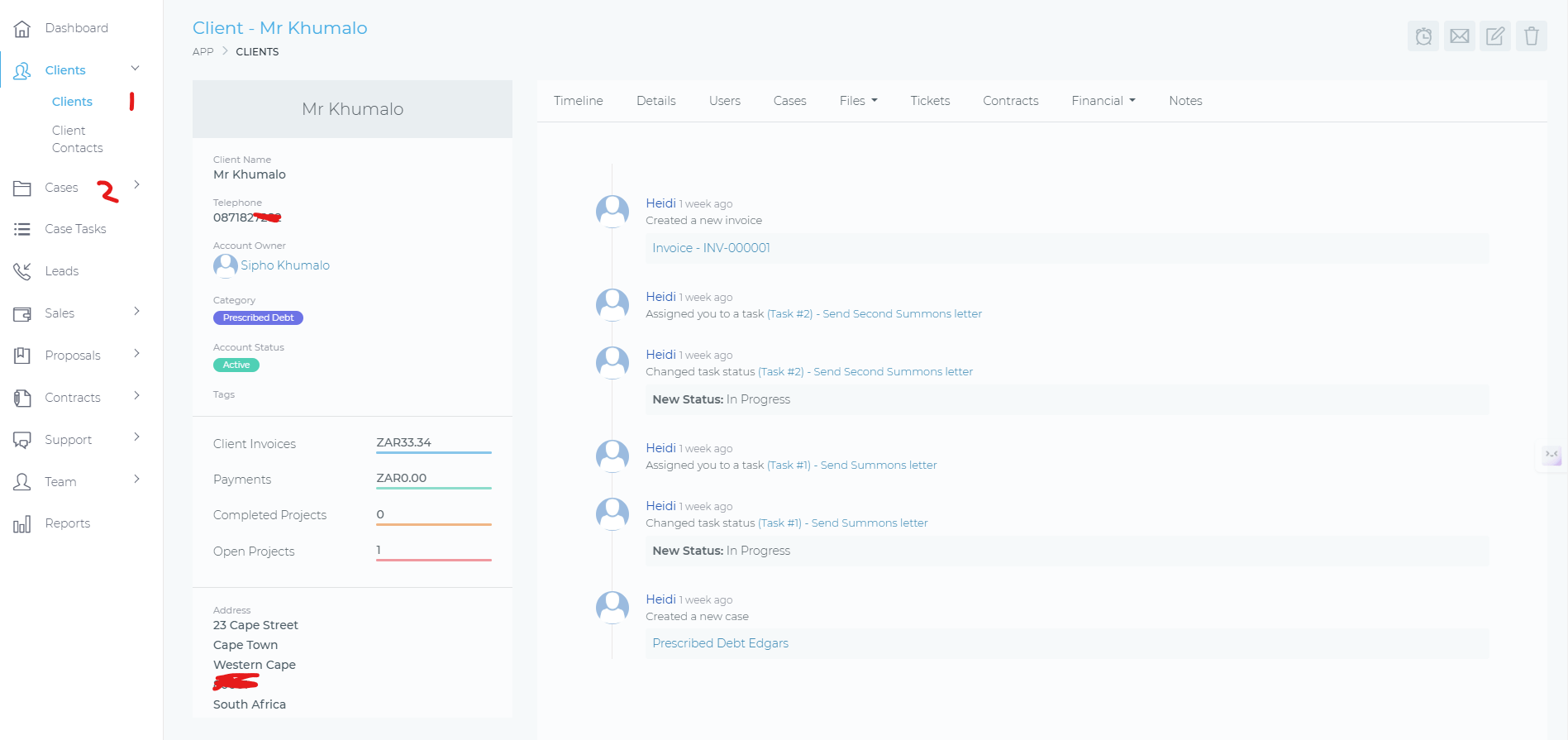

1️⃣ Step 1: Client Onboarding & Case Setup

✔ Enter the client’s details into CasePal’s intake form (Business Name, Tax Number, Contact Person).

✔ The system automatically creates a tax case file where you can store tax filings, audit requests, and compliance documents.

✔ Your client receives an email with a secure portal link to create their password and log in.

4️⃣ Step 4: Client Communication & Tax Dispute Updates

✔ Clients log into their secure portal to check case status, submit documents, or ask tax-related questions.

✔ Every time a milestone is updated (e.g., SARS response received, case submitted, dispute resolution in progress), clients get automatic email notifications.

✔ No more endless calls or follow-ups—all communication is logged in the client file.

✅ The Result? Tax cases stay structured, deadlines are met, and clients always know their case progress.

🔹 What CasePal Does for Tax Lawyers

✔ Tax Compliance Tracking – Monitor corporate filings, VAT payments, and SARS disputes.

✔ Client & Case Management – Maintain structured tax client profiles and track multiple tax cases.

✔ Task & Deadline Automation – Assign and track tax compliance tasks for businesses or individuals.

✔ Document Storage & Sharing – Securely upload and manage tax filings, audit responses, and financial documents.

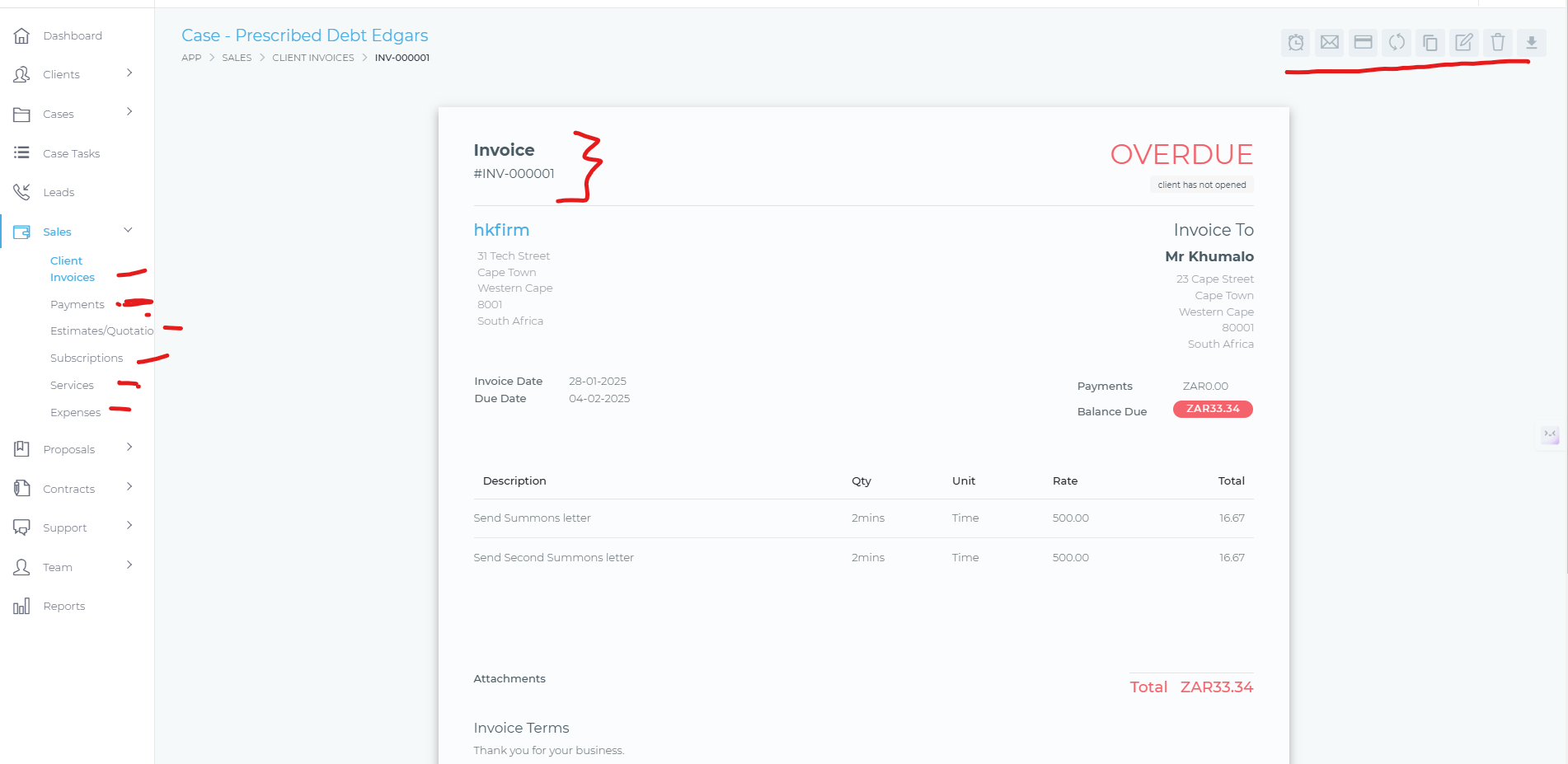

✔ Billing & Payments – Invoice per hour, flat fee, or retainer, send estimates, and track payments seamlessly.

CasePal helps tax lawyers manage tax law efficiently, without getting lost in compliance details.

FAQs – Tax Lawyers & CasePal

1️⃣ Can I track VAT, tax returns, and compliance deadlines in CasePal?

Yes! You can set up reminders for VAT filings, corporate tax returns, and SARS audit responses.

2️⃣ Can multiple lawyers or teams work on tax cases together?

Yes! You can assign different team members to specific tax disputes, compliance matters, or audits.

3️⃣ Can my tax clients track case progress?

Yes! Clients can log into their secure portal to track tax filings, receive legal updates, and upload missing documents.

4️⃣ Does CasePal support retainer billing for tax clients?

Yes! You can bill per hour, flat fee, or offer retainer-based billing for ongoing tax advisory services.

5️⃣ Is my financial and tax data secure?

Absolutely! CasePal uses bank-level encryption to protect all client tax documents, compliance records, and invoices.

CasePal Goes Beyond Tax Case Management

🚀 Extra Services for Tax Law Firms

🔹 Law Firm Websites – Get a professional WordPress website optimized for tax law clients.

🔹 Cybersecurity & Compliance Training – Ensure data security for tax-sensitive client records.

🔹 IT Support – Setup, troubleshooting, and accounting software integrations.

🔹 Digital Marketing for Tax Law Firms – Google Ads, SEO, and LinkedIn marketing to attract business clients.

💡 Tax law requires precision—CasePal helps you stay ahead of every deadline.